Debt and Stewardship Relates to Parable of the Talents

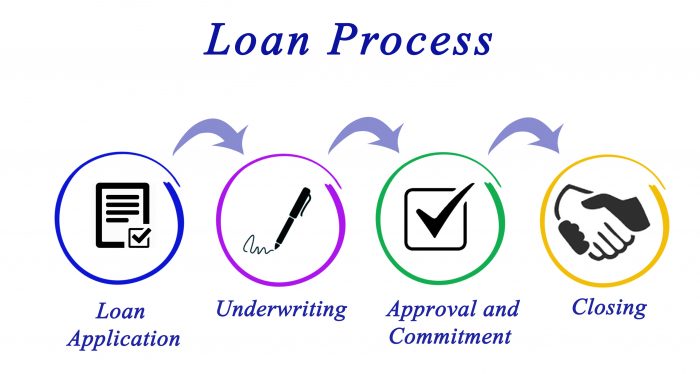

Debt and stewardship relates directly to the Parable of the Talents. Previously, we listed several spiritual principles and behaviors of stewardship. Let’s take a look at them again. However, we will compare the process steps of loan origination, loan approval, credit reporting, and debt repayment in this version.

Guiding Biblical Stewardship Principles

- Stewardship is carefully managing the resources that belong to someone else with the expectation that the resources will increase in value

- When a person borrows money from a lender, the contract states that the money belongs to the lender, and the borrower takes out a loan. The borrower is expected to make the lender’s money increase by making interest payments.

- Resources owners distribute goods according to a person’s ability to manage

- Before issuing a loan, the borrower undergoes an approval process. Past credit history, credit scores, work history, income levels, and other information are verified to ensure the borrower is capable of repaying the loan balance.

- There is always an accounting of how well a person manages the resources entrusted to them by property owners

- Lenders closely monitor the timeliness of repayment behavior patterns. They mail out monthly statements to borrowers so that they can monitor themselves. Also, lenders report information to the credit bureaus, which subsequently generate credit scores.

- It is the person’s role to develop and successfully execute a plan that increases the value of the managed goods

- The borrower has the responsibility to manage his financial affairs to ensure the lender is repaid the amounts due plus interest. This is another example of how debt and stewardship relates.

Good Steward Behaviors

- Good stewards successfully add value to the resources entrusted to them

- Borrowers make timely payments until the loan has a status of “paid in full.”

- Resource owners speak blessings over good stewards for a job well done

- Lenders send favorable reports to credit bureaus, which result in higher credit scores.

- Stewards who manage the resources of others well get rewards for their efforts, plus more resources to manage

- Loans for borrowers with good credit scores are usually approved faster. They enjoy lower interest rates, higher credit limits, and other favorable terms.

- Even more, borrowers save time and money on interest by paying off debt early.

Bad Steward Behaviors

- Expect negative events to occur as a consequence of poorly managing the resources that belong to someone else

- Lenders send unfavorable reports to credit bureaus, which result in lower credit scores. Lower credit scores increase the rates for other goods and services such as insurance premiums, larger security deposits for utilities and cell phones.

- Poor performance can cause bad stewards to receive punishment for their actions. Their access to additional resources is usually cut off.

- As a result, denial of loan requests, or less than favorable credit terms are common.

- Also, credit limits are often frozen or reduced.

- The resources in their possession are often times taken away and given to someone else

- Penalty charges such as late fees, returned check fees, and over-limit fees are punishment for mismanagement. In essence, money is taken from the borrower and given to the lender.

- Similarly, attorney fees, court fees, lawsuits, and garnishments are other ways money is forcibly taken away and given to others

Key Thoughts

“To those who use well what they are given, even more will be given, and they will have an abundance. But from those who do nothing, even what little they have will be taken away.” (Matthew 25:29 NLT)

Have you been affected by any of the behaviors and principles about debt and stewardship? If so, how?